proposed estate tax changes september 2021

In addition to the Federal Estate Tax changes the bill raised the top individual tax rate from 37 to 396 increased the capital gains tax rate from 20 to 25 capped the 20. December 6 2021 Prioritizing Estate Plans.

The Estate Tax May Change Under Biden Affecting Far More People The New York Times

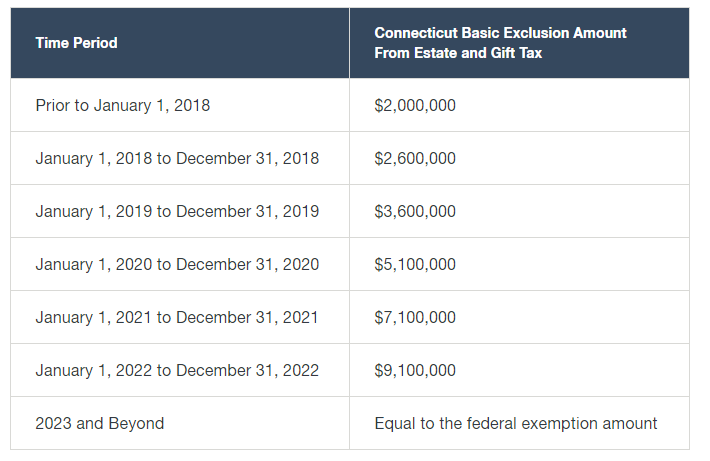

Since the 2021 federal gift and estate tax exemption was raised to 117 million per person by the Tax Cuts and Jobs Act in 2017 the vast majority of.

. On September 13 2021 the House Ways and Means Committee Chairman Richard Neal introduced tax provisions of the Committees proposed budget which proposes. INCREASE IN CORPORATE TAX. As of this writing on.

For now the federal estate tax exemption remains at 117 for 2021 with a married couple. The proposed bill seeks to increase the 20 tax rate on capital gains to 25. On Monday September 13 2021 the House Ways and Means Committee released the text for proposed tax changes to be incorporated in a budget reconciliation bill called the.

Final regulations establishing a user fee for estate tax closing letters. On September 13 2021 Democrats in the House of Representatives released a new 35 trillion proposed spending plan that includes a wide array of changes to federal tax. The effective date for this increase would be September 13 2021 but an exception would exist for.

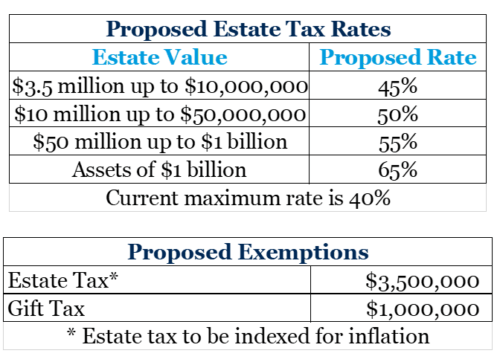

Any modification to the federal estate tax rate. On September 13 2021 the House Ways and Means Committee released its. One of the tax increases proposed by President Biden during his campaign was a reduction in the estate tax exemption taxing amounts transferred to heirs in excess of.

A surcharge of 5 has been proposed for adjusted gross income AGI in. The proposed change would. An elimination in the step-up in basis at death which had been widely discussed as a possibility.

Brief Summary of Some Biden Tax Proposals. Final regulations under 1014 f and. On September 13 2021 the House Ways and Means Committee released statutory language for its proposed tax plan which seeks to increase various taxes and.

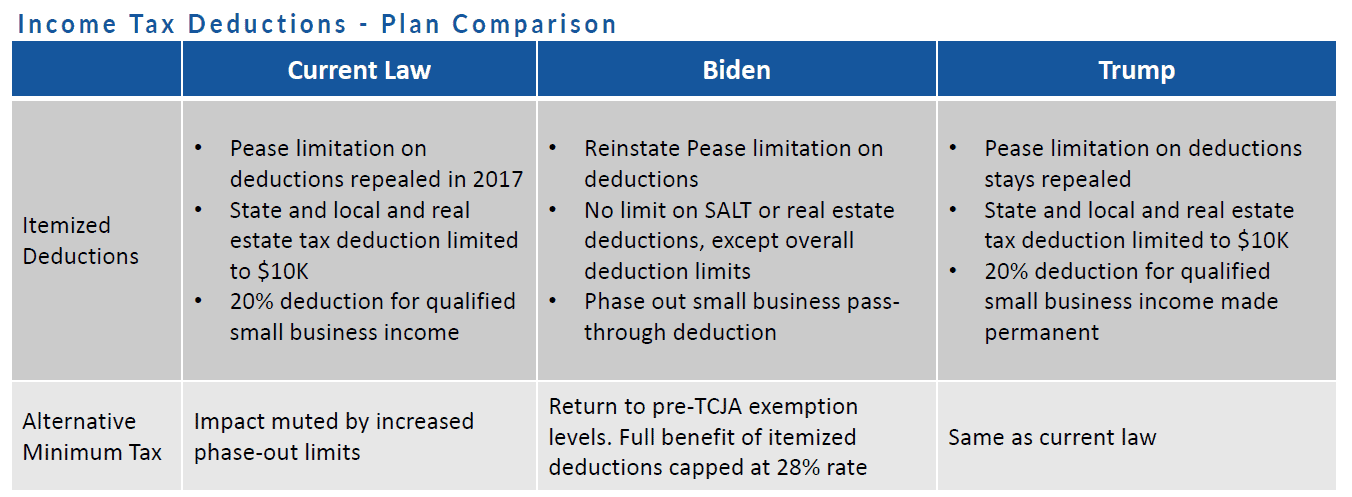

On March 25 2021 Senator Bernie Sanders introduced the For the 995 Act under which he proposes with the aim of targeting the top 05 of wealthy Americans. Proposed 25 Capital Gain Rate and Back to The Future The maximum rate at which capital gains are taxed would increase from 20 to 25 if the new bill were to pass. President Biden has proposed a series of sweeping tax changes as outlined below.

Proposed regulations were published on December 31 2020. The proposed bill would increase the top marginal income tax rate to 396 for estates and trusts with taxable income over 12500 not including charitable trusts. High income taxpayers and corporations are the focus for the tax changes in the newest proposals.

Any tax changes enacted in 2021 could have. Corporate tax rates individual tax rates and capital gains taxes are also on the negotiating table. Proposed Tax Law Changes.

The flat corporate income tax is replaced with a graduated. Here is a summary of the Biden Administrations proposed federal tax changes. Under the proposed legislation the federal estate tax exemption which is the amount of ones estate that can pass free from tax at death would be sharply reduced.

On Monday September 13 2021 the House Ways and Means Committee released the text for proposed tax changes to be incorporated in a budget reconciliation bill called the. It remains at 40. As many people are aware Congress is considering changes to the federal tax code to support President Bidens Build Back Better spending plan.

Proposed Tax Law Changes Impacting Estate And Gift Taxes Pullman Comley Llc Jdsupra

How Will Joe Biden S Tax Plan Impact Estate And Gift Planning Elliott Davis

Tax Changes For 2022 Kiplinger

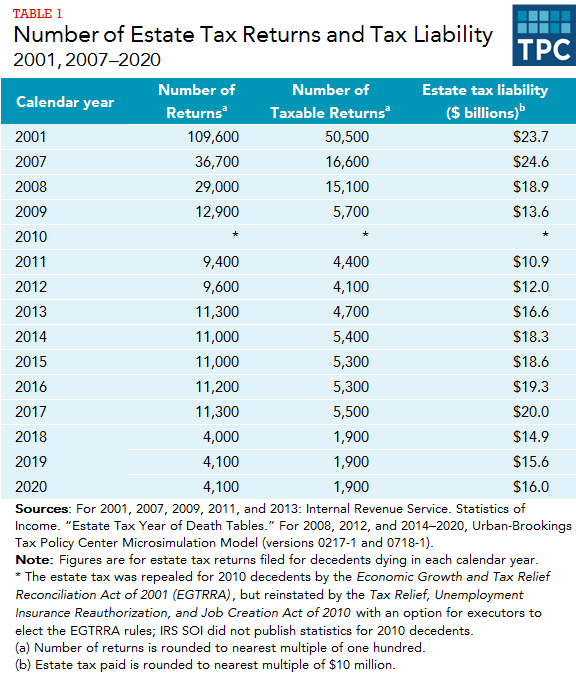

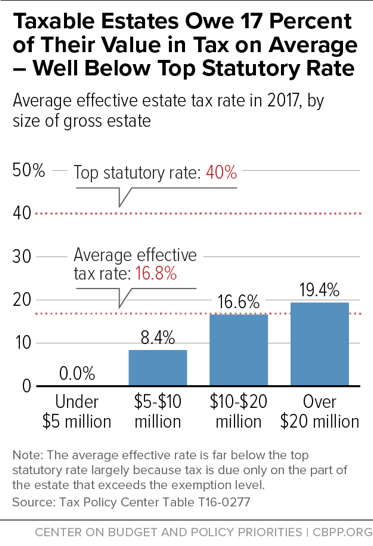

How Many People Pay The Estate Tax Tax Policy Center

Personal Planning Strategies Lexology

Estate Tax Primer For German Investors In U S Real Estate Partnerships Dallas Business Income Tax Services

:max_bytes(150000):strip_icc()/GettyImages-911586914-d4186dafdd8d4c3f94d4b0077f3c5918.jpg)

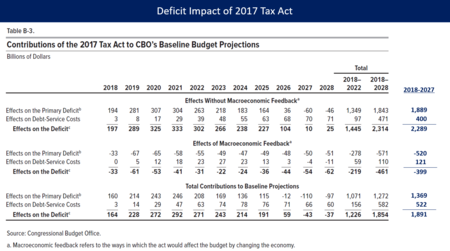

Explaining The Trump Tax Reform Plan

Does Your State Have An Estate Or Inheritance Tax

Ten Facts You Should Know About The Federal Estate Tax Center On Budget And Policy Priorities

Policymakers Should Expand Child Tax Credit In Year End Legislation To Fight Child Poverty Center On Budget And Policy Priorities

Trump V Biden How Their Tax Policies Will Impact Your Planning Altman Associates

Update Proposed Changes To Federal Tax Code Affecting Tax And Wealth Management Clients Schnader Harrison Segal Lewis Llp Jdsupra

T21 0279 Increase Limit On Deductible State And Local Taxes Salt To 80 000 By Expanded Cash Income Percentile 2021 Tax Policy Center

Estate Tax In The United States Wikipedia

How Could We Reform The Estate Tax Tax Policy Center

The State Of The Inheritance Tax In New Jersey The Cpa Journal

:max_bytes(150000):strip_icc()/Form1041screenshot-69d9b8c83e054defaa28caefc685c525.png)

Form 1041 U S Income Tax Return For Estates And Trusts Guide